marketinvestments.ru Prices

Prices

Pros And Cons Of Traditional Vs Roth Ira

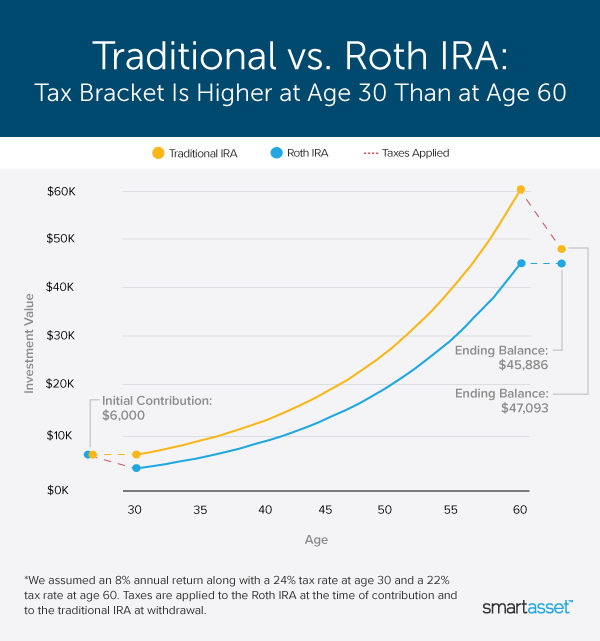

With a Traditional IRA, you enjoy immediate tax benefits through tax-deductible contributions, but you'll be taxed on your withdrawals during retirement. On the. Contributions to a Roth IRA may be limited based on an individual's income and tax filing status. Annual limits are based on the IRS Contribution limits. Traditional and Roth IRAs offer a tax-advantaged way to save for retirement, but there are contribution limits and strict rules regarding withdrawals. The primary difference between a Roth IRA and a traditional IRA is the tax treatment. When you contribute to a traditional IRA, the contributions are tax-. When weighing a traditional vs. a Roth IRA, you need to consider which gives you the best tax savings. If you expect your taxes will be lower in retirement due. Roth IRA vs. traditional IRA · There are certain income limits associated with contributing to a Roth IRA. · With a Roth IRA, you can contribute after-tax dollars. While the Roth gives no tax deduction on the front end, the growth—and eventual distribution—is federal tax-free. The Roth IRA allows one to take out % of. Pros of Traditional and Roth IRAs · Tax-free growth: Once money is in a traditional IRA, you won't pay taxes on dividends or capital gains until you withdraw the. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket. With a Traditional IRA, you enjoy immediate tax benefits through tax-deductible contributions, but you'll be taxed on your withdrawals during retirement. On the. Contributions to a Roth IRA may be limited based on an individual's income and tax filing status. Annual limits are based on the IRS Contribution limits. Traditional and Roth IRAs offer a tax-advantaged way to save for retirement, but there are contribution limits and strict rules regarding withdrawals. The primary difference between a Roth IRA and a traditional IRA is the tax treatment. When you contribute to a traditional IRA, the contributions are tax-. When weighing a traditional vs. a Roth IRA, you need to consider which gives you the best tax savings. If you expect your taxes will be lower in retirement due. Roth IRA vs. traditional IRA · There are certain income limits associated with contributing to a Roth IRA. · With a Roth IRA, you can contribute after-tax dollars. While the Roth gives no tax deduction on the front end, the growth—and eventual distribution—is federal tax-free. The Roth IRA allows one to take out % of. Pros of Traditional and Roth IRAs · Tax-free growth: Once money is in a traditional IRA, you won't pay taxes on dividends or capital gains until you withdraw the. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket.

We explain how IRAs work and discuss some of the benefits of a Roth IRA. · Traditional IRAs provide you with tax advantages now when saving for retirement, Roth. Traditional IRAs: Pros vs. Cons · No income limits to open and contribute to a traditional IRA · Eligible tax deductions for contributions can be claimed whether. Traditional vs. Roth IRAs at a glance ; Tax benefits. Contributions may be fully or partially deductible, depending on income and filing status. Contributions. Traditional IRA contributions are tax-deductible tax returns for the year you make the contribution; withdrawals in retirement are taxed at ordinary income tax. While traditional IRAs may provide immediate tax breaks because they're deductible and funded with pre-tax money, Roth IRA benefits happen on the back end, as. While IRAs are tax-advantaged, there are differences in those specific advantages. For starters, contributions to a Traditional IRA are tax-deferred. This means. When choosing between a Roth IRA and a Traditional IRA, it's important to understand each account's unique set of rules and benefits. The Roth IRA avoids lifetime RMDs, avoids state estate taxes, and allows you to truly maximize contributions if you can pay tax with outside funds. However, the. Traditional and Roth IRAs offer tax advantages and a wide choice of investment options. · You can evaluate the potential benefits and risks of a rollover from a. This may or may not be true. Let's compare a Roth vs. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for. In one of the articles I've read in the finance strategists website, the primary advantage of a roth ira is that its funds can be withdrawn tax-. Differences between Roth and traditional IRAs ; Contributions can be withdrawn anytime, tax-free; Earnings tax-free if withdrawn at least five tax years after. Key Takeaways: · Roth IRAs offer tax-free withdrawals in retirement but no immediate tax breaks. · Traditional IRAs provide tax-deductible contributions and tax. Despite not offering an upfront tax deduction, a Roth IRA can offer flexibility to manage your taxes and spending in retirement because you can withdraw money. Any deductible contributions and earnings you withdraw or that are distributed from your traditional IRA are taxable. Also, if you are under age 59 ½ you may. Retirement accounts like (k)s, (b)s, and IRAs have a lot in common. They all offer tax benefits for your retirement savings, like the potential for tax-. Roth IRAs allow for individuals to put money into a retirement account that can grow tax-free. This means that no matter if your earnings on the account are. However, withdrawals from a Traditional IRA during retirement are subject to income tax. In contrast, Roth IRA contributions are made with after-tax money. There are no penalties on withdrawals of Roth IRA contributions. But there's a 10% federal penalty tax on withdrawals of earnings. Exceptions to the penalty tax. Key Points ; Roth IRA, Traditional IRA ; You can make after-tax contributions. You can make pretax contributions. ; No up-front tax advantages. Making pretax.

Waymo Stock Name

As a private company, Waymo doesn't have a stock symbol. But its parent company, Alphabet, most certainly does. Alphabet's stock ticker is GOOG. From what we. See the latest Google stock price (NASDAQ:GOOG), related news, valuation, dividends and more to help you make your investing decisions. Waymo is a privately held company. Therefore, it does not have a stock symbol or “ticker” that trades on public exchanges like the NYSE, Nasdaq, etc. Get a real-time ZEEKR Intelligent Technology Holding Limited (ZK) stock price quote with breaking news, financials, statistics, charts and more The Waymo-. Google launched its Waymo division to develop and market consumer-ready driverless vehicles around the globe. The company, along with several others in the. Its stocks trade on the NASDAQ Stock Exchange through two classes of shares, GOOG and GOOGL shares. Waymo, GV, Jigsaw, Loon, Sidewalk Labs, and CapitalG. Waymo—formerly the Google self-driving car project—makes it safe and easy for people & things to get around with autonomous vehicles. Take a ride now. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. name, email address and other associated personal information for. Accredited investors can buy pre-IPO stock in companies like Waymo through EquityZen funds. These investments are made available by existing Waymo shareholders. As a private company, Waymo doesn't have a stock symbol. But its parent company, Alphabet, most certainly does. Alphabet's stock ticker is GOOG. From what we. See the latest Google stock price (NASDAQ:GOOG), related news, valuation, dividends and more to help you make your investing decisions. Waymo is a privately held company. Therefore, it does not have a stock symbol or “ticker” that trades on public exchanges like the NYSE, Nasdaq, etc. Get a real-time ZEEKR Intelligent Technology Holding Limited (ZK) stock price quote with breaking news, financials, statistics, charts and more The Waymo-. Google launched its Waymo division to develop and market consumer-ready driverless vehicles around the globe. The company, along with several others in the. Its stocks trade on the NASDAQ Stock Exchange through two classes of shares, GOOG and GOOGL shares. Waymo, GV, Jigsaw, Loon, Sidewalk Labs, and CapitalG. Waymo—formerly the Google self-driving car project—makes it safe and easy for people & things to get around with autonomous vehicles. Take a ride now. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. name, email address and other associated personal information for. Accredited investors can buy pre-IPO stock in companies like Waymo through EquityZen funds. These investments are made available by existing Waymo shareholders.

Waymo ; Valuation & Funding. Deal Type 5. Later Stage VC ; Patents · Publication ID USA1 ; Investors (15). Investor Name Temasek Holdings. Search from thousands of royalty-free Waymo stock images and video for your next project. Download royalty-free stock photos, vectors, HD footage and more. Related ETFs - A few ETFs which own one or more of the above listed Google stocks. Symbol, Grade Our Relative Strength Rating, Name, Weight. Andreessen Horowitz. Anduril, OpenAI, xAI, Waymo, Hadrian, Zipline, Wiz, Databricks, Ripple, Mistral AI What is Mistral AI's stock ticker symbol? Mistral AI. Waymo is owned by Alphabet Inc., Google's parent company. So technically they already are, just not under the "Waymo" name. Dear investors, USA Waymo, the self-driving sub company of $GOOG ($NSDQ) Search for a market's symbol or name (AAPL or Apple) or an investor's name. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. Depending on the exchange, the stock ticker may vary. Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Tip: Try a valid symbol or a specific company name for relevant results. meaning that while it was going to start selling stock, it didn't intend to adhere to the whims of Wall Street. But the founders and c suite wanted that. market, thanks to Waymo's relentless efforts. Also, it has bolstered its footprint in the healthcare industry with its life science division, Verily. Stock Name. In December , the project was renamed Waymo and spun out of Google as part of Alphabet. In October , Waymo became the first company to offer service to. Included in an investment in Alphabet is top autonomous vehicle start-up Waymo. For years, Google has been using its highly profitable internet advertising. Watch how a team of Cruisers who share a passion for cycling worked name, email, phone number, etc.), you may opt-out of Cruise sharing such. (Waymo), and more. Alphabet's operating margin has been 25%%, with Type a symbol or company name. When the symbol you want to add appears, add. Stock analysis for Alphabet Inc (GOOGL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Waymo Logo. Waymo. Waymo operates as a technology company focused on autonomous driving in the transportation industry. The company offers a ride-hailing. shares of Alphabet, which will continue to trade under the stock ticker symbols GO By putting the name Waymo between the main brand and the. Waymo. One final thought before you rush out to buy Alphabet shares: the company trades on the US NASDAQ stock exchange under two names: GOOG and GOOGL. Alphabet Inc. - Class A Shares (GOOGL) · Performance · Highlights · Analyst Recommendation · Analyst Forecast · Company Financials · Technicals Summary · Peers.

Current Ira Interest Rates

Variable Rate IRA - Premier Rates1,3. Must be a Five Star Bank Premier APY, Interest RATE, APY, Interest Rate, APY. 18 Month, %, %, %, Fixed interest rates that provide a guaranteed return; Low risk compared with other investments; Higher interest rates than savings accounts ; Lower returns. IRA Certificates of Deposit (CDs) ; Retirement Flex 10 Month CD · %, % ; Retirement Flex 20 Month CD · %, % ; Retirement Flex 30 Month CD · %. Annual Percentage Yield. %. Maximum savings with a fixed rate. Available You may make current-year contributions at any time of the year. IRS Tax. IRA Rates. Description, Dividend, APY*, Minimum Balance. Time Deposit. Variable Rate, %, %. CD & IRA Options from First Independent Bank ; Term. Minimum Deposit. Interest Rate. Annual Percentage Yield. Penalty for Early Withdrawal ; 3 Month, $2,, Call us for rates or to open an account: · For Featured CD IRA, –% depending on balance and term · % depending on balance and term. Compare our IRA CD rates to your current bank's rates. Initial Deposit After maturity, if your CD rolls over, you will earn the offered rate of interest in. IRA Accounts ; 12 Month Fixed · $,, % ; 24 Month Fixed, $, % ; 24 Month Fixed · $50,, % ; 24 Month Fixed · $,, %. Variable Rate IRA - Premier Rates1,3. Must be a Five Star Bank Premier APY, Interest RATE, APY, Interest Rate, APY. 18 Month, %, %, %, Fixed interest rates that provide a guaranteed return; Low risk compared with other investments; Higher interest rates than savings accounts ; Lower returns. IRA Certificates of Deposit (CDs) ; Retirement Flex 10 Month CD · %, % ; Retirement Flex 20 Month CD · %, % ; Retirement Flex 30 Month CD · %. Annual Percentage Yield. %. Maximum savings with a fixed rate. Available You may make current-year contributions at any time of the year. IRS Tax. IRA Rates. Description, Dividend, APY*, Minimum Balance. Time Deposit. Variable Rate, %, %. CD & IRA Options from First Independent Bank ; Term. Minimum Deposit. Interest Rate. Annual Percentage Yield. Penalty for Early Withdrawal ; 3 Month, $2,, Call us for rates or to open an account: · For Featured CD IRA, –% depending on balance and term · % depending on balance and term. Compare our IRA CD rates to your current bank's rates. Initial Deposit After maturity, if your CD rolls over, you will earn the offered rate of interest in. IRA Accounts ; 12 Month Fixed · $,, % ; 24 Month Fixed, $, % ; 24 Month Fixed · $50,, % ; 24 Month Fixed · $,, %.

View our IRA CD interest rates and calculator today Transfer money that is not currently deposited in any type of retirement account directly into our IRAs. Rate Information ; 12 months, %, % ; 24 months, %, % ; 36 months, %, % ; 48 months, %, %. Save and transfer existing funds to grow your money for your future retirement with competitive CD Rates and Traditional or Roth IRAs. Get the latest CD Rates and IRA interest rates from Ephrata National Bank - our rates are competitive and we offer many finance options. Visit Citizens to learn about available IRA accounts, including IRA Savings plans and CDs. View IRA rates, compare benefits and open an IRA account today. Federal Reserve Rates: Changes in federal rates can impact IRA rates. · Market Conditions: Market performance influences returns for Traditional and Roth IRAs. Choose from a variety of terms, with higher rates for higher balances. CD Balance. Current APY*. Personal IRA CD Rates ; 30 Month, %, % ; 36 Month, %, % ; 48 Month, %, % ; 60 Month, %, %. certificateS OF DEPOSIT AND INDIVIDUAL RETIREMENT ACCOUNTS ; Term Deposit Certificate Rate SPECIALS ; 7 Month*, %, % ; 12 Month**, %, % ; 23 Month*. IRA Certificates of Deposit ; 24 Months, $, %, %, $10 ; 30 Months^, $, %, %, $ IRA CDs ; 36 Months, %, % ; 42 Months, %, % ; 48 Months, %, % ; 54 Months, %, %. IRA Rates ; Term13 Month (90 Day), Interest Rate%, Annual Percentage Yield (APY)% ; Term16 Month ( Day), Interest Rate%, Annual Percentage Yield . Current Promotional Rates ; Term, APY ; New Money: ; 7 Month¹, % ; New or Existing Money: ; 8 Months², %. Best IRA CD rates ; Synchrony Bank IRA certificates of deposit · % to % · $0 ; NASA Federal Credit Union IRA certificate · % to % · $1, or $10, % APY1 7 Month CD Rate Special · Get a great rate on a CD · How to choose between CDs and IRAs · Find the CD that's right for you · Find the IRA that's right. Higher earnings help cover the cost of a comfortable retirement lifestyle ; % · %. Current Rates ; 6 - 8 MONTHS, %, % ; 8 MONTHS - PROMOTIONAL RATE*, %, % ; 12 - 17 MONTHS, %, % ; 13 MONTHS - PROMOTIONAL RATE*, %, %. The Annual Percentage Yield assumes interest remains on deposit until maturity. A fee may be imposed for early withdrawal. A withdrawal will reduce earnings. CURRENT INTEREST RATE FOR THAT TERM AND CURRENT BALANCE. You will have a grace period of ten calendar days after the maturity date to withdraw the funds. Short-Term Certificate Rates ; Rates as of Sep 01, ET. ; % · % · % · Rates as of Sep 01, ET. ; % · % · % · Rates as of Sep 01, ET.

Invest In Mutual Funds Robinhood

Stock rewards not claimed within 60 days may expire. See full terms and conditions at marketinvestments.ru Securities trading is offered through Robinhood. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. Invest in stocks, options, and ETFs at your pace and commission-free. Investing Disclosures. Learn more. Stocks & funds offered through Robinhood Financial. Fortunately, easy-to-use investing platforms like Robinhood, Acorns, SoFi mutual funds as well as many other investments such as individual stocks and bonds. Robinhood: How this Smartphone app is changing the investment landscape for young novice investors. When investing in stocks or mutual funds on online trading sites like Robinhood or E-Trade, it's important to be aware of potential fees and. Securities trading offered through Robinhood Financial LLC, Member SIPC, a registered broker-dealer, and a subsidiary of Robinhood Markets, Inc. Was this. According to ICI data, as measured by equity mutual funds A visible example of this resurgence is the explosion of the electronic trading platform Robinhood. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Stock rewards not claimed within 60 days may expire. See full terms and conditions at marketinvestments.ru Securities trading is offered through Robinhood. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. Invest in stocks, options, and ETFs at your pace and commission-free. Investing Disclosures. Learn more. Stocks & funds offered through Robinhood Financial. Fortunately, easy-to-use investing platforms like Robinhood, Acorns, SoFi mutual funds as well as many other investments such as individual stocks and bonds. Robinhood: How this Smartphone app is changing the investment landscape for young novice investors. When investing in stocks or mutual funds on online trading sites like Robinhood or E-Trade, it's important to be aware of potential fees and. Securities trading offered through Robinhood Financial LLC, Member SIPC, a registered broker-dealer, and a subsidiary of Robinhood Markets, Inc. Was this. According to ICI data, as measured by equity mutual funds A visible example of this resurgence is the explosion of the electronic trading platform Robinhood. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index.

It also commission-free cryptocurrency trading in the through Robinhood Crypto, LLC. It provides crypto recurring investments, allowing customers to. ROBINHOOD SECURITIES, LLC. ROBINHOOD SECURITIES, LLC. CRD#: /SEC#: B. Brokerage Firm Regulated by FINRA (Florida district office). MAIN ADDRESS. We make it easy to transfer all or part of an account to Fidelity—including stocks, bonds, mutual funds, and other security types—without needing to sell your. Is the Robin Hood app good to first start investing? Is the Robinhood app legitimate and safe? How do I contact (Robinhood) support (+. No, mutual funds are not available at Robinhood. However, if you are searching for a good broker that offers mutual funds, check out our best brokers for funds. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? Just like with your Robinhood non-retirement account, you can set up recurring investments for stocks or ETFs within your Robinhood IRA accounts. About. You can explore the wide variety of mutual funds and ETFs (exchange-traded funds) we offer. Move your taxable investing account, such as a general investing. mutual funds, for example).” “I use the app Robinhood for commission-free stock trading, putting a little of my set-aside savings money into the app each month. Investments you can make on Robinhood · Open my account · How to send in DEMOCRATIZE FINANCE FOR ALL™. Product. Invest · Learn. Legal & Regulatory. Terms. If you're seeking a full-service investment brokerage platform with access to bonds, mutual funds and futures trading, Robinhood isn't for you. That said. Robinhood Investor Index tracks the performance of the top most owned investments on Robinhood, in aggregate. · The investments that make up the index are. Investment Options: Robinhood offers a wide selection of ETFs that cover various asset classes, sectors, and market indices. These ETFs allow investors to gain. Can You Buy Index Funds on Robinhood? Yes, Robinhood carries a variety of ETFs can also help you invest in specific industries or niches. For. Can you trade mutual funds at Robinhood as of June ? No, mutual fund trading is not available at Robinhood. Robinhood is a US-based zero-commission broker. The Robinhood app is a trading platform, and the app offers its customers valuable services such as zero trade commissions and various investment options. The. After you link your bank account and buy your first investment, you'll receive your Robinhood free stock. You'll get a notification when your reward is ready or. Robinhood offers investment choices like crypto and options you may only find at some brokers. It also offers margin trading, with a lower rate for Robinhood. Want to jump straight to the answer? The best Robinhood alternatives are Interactive Brokers, Webull, and TradeStation.

Embrace Pet Insurance Usaa Discount

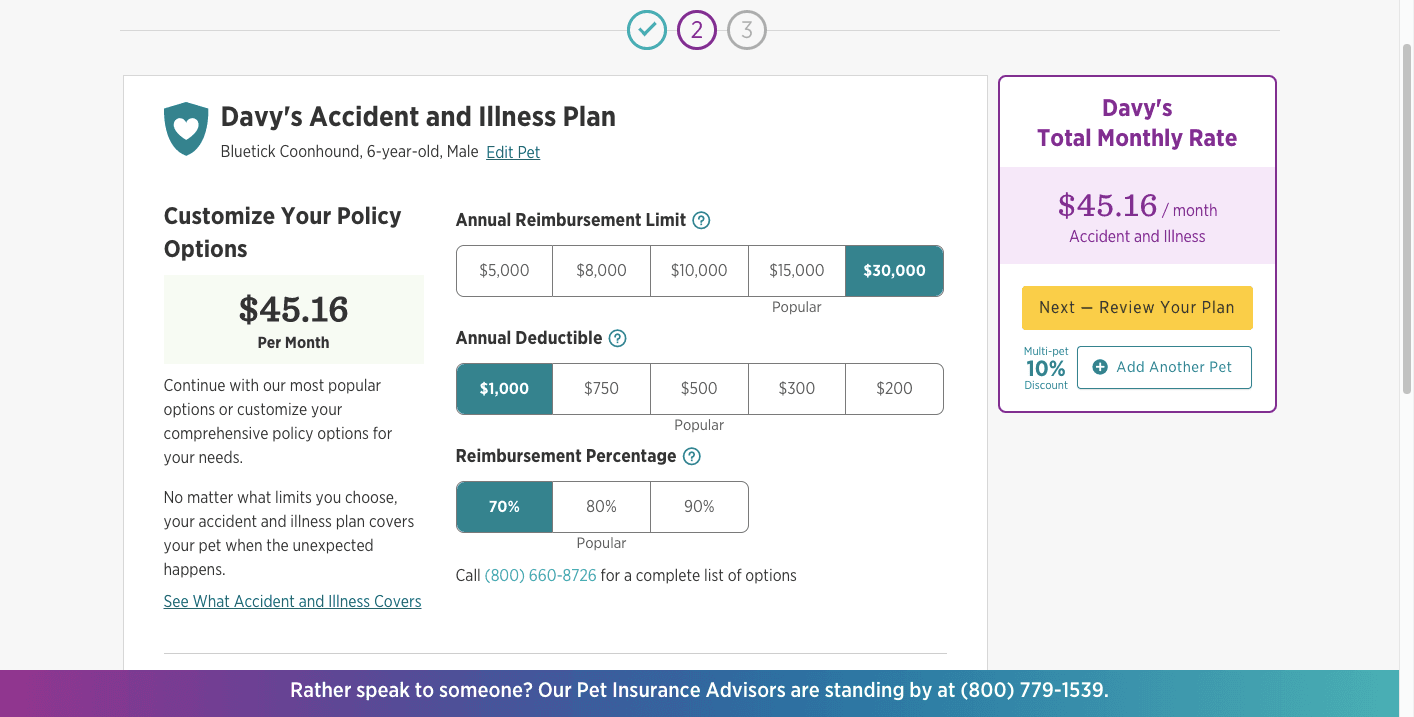

Pet Insurance. Help protect your fur baby. Save up to 25% on pet insurance through our alliance with marketinvestments.ru note EMBRACE PET INSURANCE, Richmond Rd, Cleveland, OH , 62 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm. USAA began offering a discounted rate for Embrace Pet Insurance plans in USAA policyholders receive a 10% discount for enrolling multiple pets. Embrace Pet Insurance, preferred by USAA, has been amazing. Filing claims is simple, with direct deposit reimbursement in days. Our Blue Heeler had. M posts. Discover videos related to Embrace Pet Insurance on TikTok. See more videos about Turtle Pet, Embrace Masculinity, My Pets, Small Pets. All Embrace insurance policies have a day waiting period for illnesses, while accident coverage starts on your policy's effective date, which you'll receive. 10% Multiple Pet Discount – this is automatically added to policies with two or more pets · 5% Military Discount – available if you or someone in your immediate. I originally signed up for Embrace through USAA since I have had great experience with them. But, over the past couple years premiums slowly. To get the 30% discount on eligible items, enter promo code USAABDAY at checkout. q. Pet Insurance disclosure. Pet health insurance is administered by Embrace. Pet Insurance. Help protect your fur baby. Save up to 25% on pet insurance through our alliance with marketinvestments.ru note EMBRACE PET INSURANCE, Richmond Rd, Cleveland, OH , 62 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm. USAA began offering a discounted rate for Embrace Pet Insurance plans in USAA policyholders receive a 10% discount for enrolling multiple pets. Embrace Pet Insurance, preferred by USAA, has been amazing. Filing claims is simple, with direct deposit reimbursement in days. Our Blue Heeler had. M posts. Discover videos related to Embrace Pet Insurance on TikTok. See more videos about Turtle Pet, Embrace Masculinity, My Pets, Small Pets. All Embrace insurance policies have a day waiting period for illnesses, while accident coverage starts on your policy's effective date, which you'll receive. 10% Multiple Pet Discount – this is automatically added to policies with two or more pets · 5% Military Discount – available if you or someone in your immediate. I originally signed up for Embrace through USAA since I have had great experience with them. But, over the past couple years premiums slowly. To get the 30% discount on eligible items, enter promo code USAABDAY at checkout. q. Pet Insurance disclosure. Pet health insurance is administered by Embrace.

Embrace thanks our active and former military members, as well as our veterans by offering a 5% discount on their accident and illness policy premium (discount. Save money with pet insurance. Members can save up to 25% on their cats' and dogs' accident and illness coverage. Coverage may include diagnostic testing. Embrace provides plans for insurance giants Allstate, Geico and USAA. Offers a 10% multiple pet discount (depends on state); Offers a 5% discount for. Embrace Pet Insurance. Richmond Rd Cleveland, OH Phones: () marketinvestments.ru Farmers Insurance. () $25 bonus. Wellness Rewards members get an extra $25 to use on included or eligible preventative care services. Quarterly pet health eNewsletter. All Embrace insurance policies have a day waiting period for illnesses, while accident coverage starts on your policy's effective date, which you'll receive. Embrace Pet Insurance Covers: Accidents & Illnesses · Embrace Pet Insurance will not pay for: Cosmetic, elective or preventative procedures such as de-worming. There is a 5% military discount and a 10% multi-pet discount (the multi-pet discount is 5% in some states). Embrace charges a one-time $25 enrollment fee. Compare USAA pet insurance provider with Spot Pet insurance and look for yourself how spot pet insurance plan stacks up in the competition. Embrace Pet Insurance - 15% USAA Discount! TruPanion · Healthy Paws Pet Insurance · Pet Plan Pet Insurance · Pets Best Insurance. To learn more about Pet Health. Members qualify for discounts through USAA's partnership with Embrace, so they can save and protect their pets at the same time. There's a lot of flexibility. You're looking anywhere between dollars a month depending on the pet type (dog, cat, large, small) and type of coverage (accidental injury, illness. Get the pet insurance that has your best friend in mind. USAA members save up to 25%. Rates and discounts vary, are determined by many factors, and are subject to change. Wellness Rewards is offered as a supplementary, non-insurance benefit. All USAA members are eligible for pet insurance. If you're a USAA member, you can save up to 25% on your premiums with the following discounts: 15% membership. On average, Embrace costs $15 to $40 per month for Accident & Illness coverage. Remember that pet insurance pricing depends on your animal's breed, age, zip. Embrace was an easy choice after reviewing my pets options. Unfortunately I used my Embrace Insurance a lot for my pet. From the start of her coverage to the. Every Embrace accident and illness policy covers the following dental issues (and more) for up to $ for each policy term. Reduce the cost of your pet's routine care with the Embrace Wellness Rewards program. Our popular pet wellness and preventative care plan is the perfect. Today's the day to celebrate your favorite fur-baby on National Dog Day. Help protect your dog and your wallet with pet insurance.

Public Stock Offering

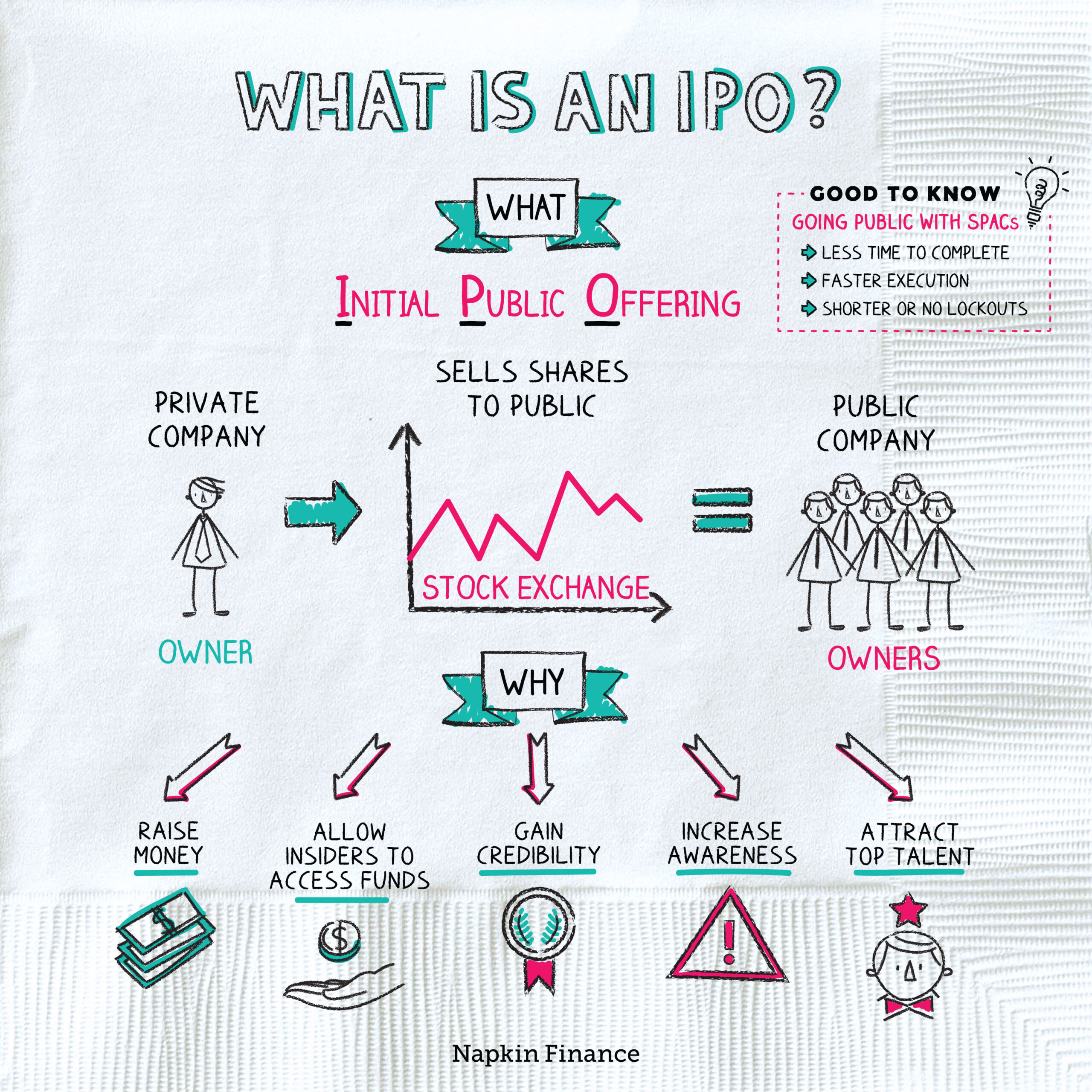

An initial public offering is the primary process through which a private company first offers to sell shares to public investors. A company sells securities to public investors by conducting an initial public offering, which makes them a public company. Once public, the company must file. An IPO is an initial public offering. In an IPO, a privately owned company lists its shares on a stock exchange, making them available for purchase by the. A primary stock offering is the first time a security or bond is floated or sold to the public. As a result, a company raises the capital it needs to grow and. An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. This allows the company to raise funds by selling. In public offerings, the investment bank will typically purchase stock directly from the company, putting them in a position of risk if they're unable to gain. A public offering is a sale or equity shares or debt securities by an organization to the public in order to raise funds for the company. Public offerings. An initial public offering (IPO) is the event when a privately held organization initially offers stock shares in the company on a public stock exchange. A public offering is the offering of securities of a company or a similar corporation to the public. Generally, the securities are to be publicly listed. An initial public offering is the primary process through which a private company first offers to sell shares to public investors. A company sells securities to public investors by conducting an initial public offering, which makes them a public company. Once public, the company must file. An IPO is an initial public offering. In an IPO, a privately owned company lists its shares on a stock exchange, making them available for purchase by the. A primary stock offering is the first time a security or bond is floated or sold to the public. As a result, a company raises the capital it needs to grow and. An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. This allows the company to raise funds by selling. In public offerings, the investment bank will typically purchase stock directly from the company, putting them in a position of risk if they're unable to gain. A public offering is a sale or equity shares or debt securities by an organization to the public in order to raise funds for the company. Public offerings. An initial public offering (IPO) is the event when a privately held organization initially offers stock shares in the company on a public stock exchange. A public offering is the offering of securities of a company or a similar corporation to the public. Generally, the securities are to be publicly listed.

Secondary Public Offerings (SPOs). Data is currently not available. Stock Splits. 8 Events. Discover which stocks are splitting, the ratio, and split ex-date. An initial public offering (IPO) is the process of a company selling its shares to the public for the first time. IPOs are typically used by young companies. “Alternative assets,” as the term is used at Public, are equity offered by Public Investing. Keep in mind that other fees such as regulatory. When a company goes through an IPO, the general public is able to buy shares and own a portion of the company for the first time. An IPO is often referred to as. When a private company first sells shares of stock to the public, this process is known as an initial public offering (IPO). In essence, an IPO means that a. Initial Public Offering (IPO) refers to the process where private companies sell their shares to the public to raise equity capital from the public. An initial public offering (IPO) takes place when a company offers itself up for public ownership by listing and selling its shares on a stock exchange. Going public through an IPO may include the spin-off or carve-out of the subsidiary of a parent company that seeks its own listing on a stock exchange. A SPAC . Common Stock8/26/; CDW Corporation Common Stock8/26/; Golar Lng Ltd8/26/ Earnings. Events. Track companies who are expected to release earnings. and also known as an additional public offering (APO), involves the issuer offering more shares in the primary market after the IPO. In most scenarios, issuers. An initial public offering (IPO) is listing and selling new, publicly tradeable, shares to investors that receive an allotment from an underwriter or. An initial public offering, or IPO, generally refers to when a company first sells its shares to the public. For more information about IPOs generally. A follow-on offering (FPO) is when a public company issues more shares after their initial public offering (IPO). It happens when the company. The underwriters and the company that issues the shares control the IPO process. They have wide latitude in allocating IPO shares. The SEC does not regulate. An IPO is a private company's first offering of new stock to the investing public. Learn how an IPO process works, how to find the latest IPOs online. An initial public offering is the first offering to the public of the common stock of a formerly privately held firm. The sale of the stock provides an infusion. Navigate the complexities of corporate finance with our stock offerings news feed. We track real-time updates on companies issuing new shares, from public. Initial Public Offerings (IPOs). An investment bank's equity capital markets group helps private companies determine if an initial public offering of stock is a. IPOs, or initial public offerings, are a pathway for private companies to go public by offering shares to the public and listing them on stock exchanges. An initial public offering (IPO) is one of the methods that companies can use to go public – which will make its stock available to retail traders.

New Student Loan Rates

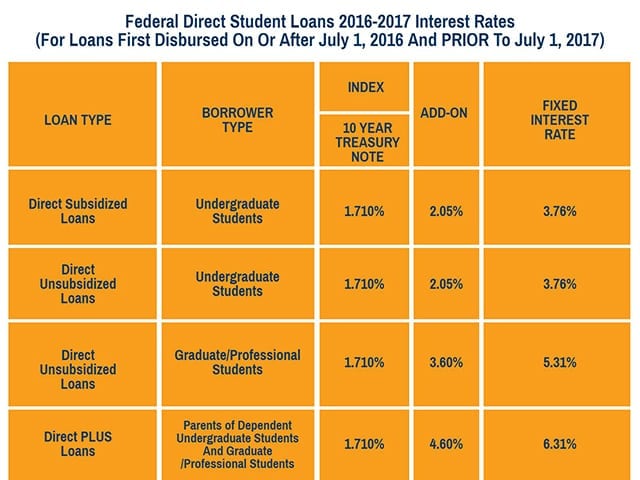

Federal student loans interest rates for the school year range from % to %. As of July, , all federal student loans have fixed interest. Need a New Private Student Loan? If you're looking for a new private student loan, visit Earnest for a free rate check and a simple application, where. Federal student loan rates are hitting % for the year, the highest in over a decade. Expect higher interest costs if you're. College Access Loan (CAL) Program. The CAL Program provides alternative education loans to Texas students who are unable to meet cost of attendance. Visit the. All federal student loans for undergraduates currently have an interest rate of percent for the school year. Compare student loan fixed interest rates from % and variable interest rates from % APR ¹ without affecting your credit score. It only takes. Direct subsidized (graduate students): %; PLUS Loan (graduate students and parents of undergraduate students): %. Private student loan interest rates. Summary: Interest rates on new federal Direct Stafford loans are fixed for the life of the loan. For loans taken out for the - school year. Student Undergraduate Loan 10 Year Repayment ; Deferred Repayment. Interest Rate ; Deferred Repayment · % ; Deferred Repayment · %. Federal student loans interest rates for the school year range from % to %. As of July, , all federal student loans have fixed interest. Need a New Private Student Loan? If you're looking for a new private student loan, visit Earnest for a free rate check and a simple application, where. Federal student loan rates are hitting % for the year, the highest in over a decade. Expect higher interest costs if you're. College Access Loan (CAL) Program. The CAL Program provides alternative education loans to Texas students who are unable to meet cost of attendance. Visit the. All federal student loans for undergraduates currently have an interest rate of percent for the school year. Compare student loan fixed interest rates from % and variable interest rates from % APR ¹ without affecting your credit score. It only takes. Direct subsidized (graduate students): %; PLUS Loan (graduate students and parents of undergraduate students): %. Private student loan interest rates. Summary: Interest rates on new federal Direct Stafford loans are fixed for the life of the loan. For loans taken out for the - school year. Student Undergraduate Loan 10 Year Repayment ; Deferred Repayment. Interest Rate ; Deferred Repayment · % ; Deferred Repayment · %.

Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! Variable rates range from % APR to % APR (excludes % Auto Pay discount). Earnest variable interest rate student loan origination loans are based on. Summary: Interest rates on new federal Direct Stafford loans are fixed for the life of the loan. For loans taken out for the - school year. Federal student loans interest rates for the school year range from % to %. As of July, , all federal student loans have fixed interest. Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. Private student loan interest rates. It's usually best to start with federal student loans, which have an interest rate of percent for undergraduate students for the school year. College loans with zero fees³, low rates, and 40 flexible payment options⁴ – no other student loan has more. ⏰ Take advantage of new lower rates on college. The new legislation would allow Americans with public student loans to refinance their loans to an interest rate of 0% until December 31, Recently. Compare student loan fixed interest rates from % and variable interest rates from % APR ¹ without affecting your credit score. It only takes. For loans disbursed between July 1, and July 1, , the interest rate is % for undergraduate direct subsidized loans and direct unsubsidized loans and. For the school year, the interest rate on Direct PLUS loans is %. But in June , some private student loan rates are actually lower. Also. In the May 12, Treasury auction, the yield on the year note came in at , so the new Direct Loan interest rate for the academic year will be. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! For loans disbursed between July 1, and July 1, , the interest rate is % for undergraduate direct subsidized loans and direct unsubsidized loans and. Direct PLUS interest rate of % applies to loans disbursed on or after July 1, and on or before June 30, The interest rate for Direct PLUS loans. Direct Loans ; Undergraduate Students, %, %, % ; Graduate/ Professional Students, %, %, %. 7 out of 10 families use a loan to cover education costs. Are you new to the world of education loans? Let VSAC be a loan resource so you can. And we never charge origination or application fees. Students. Here's our current student loan interest rates: Buying New Clothes. Difference. The rate or the year Treasury note on May 8, came in at %, so the new Direct Loan interest rate for the academic year is %, and the. The interest rate for unsubsidized Stafford loans made to graduate students is %. Rates are fixed for the life of the loan. (For more, see How Interest.

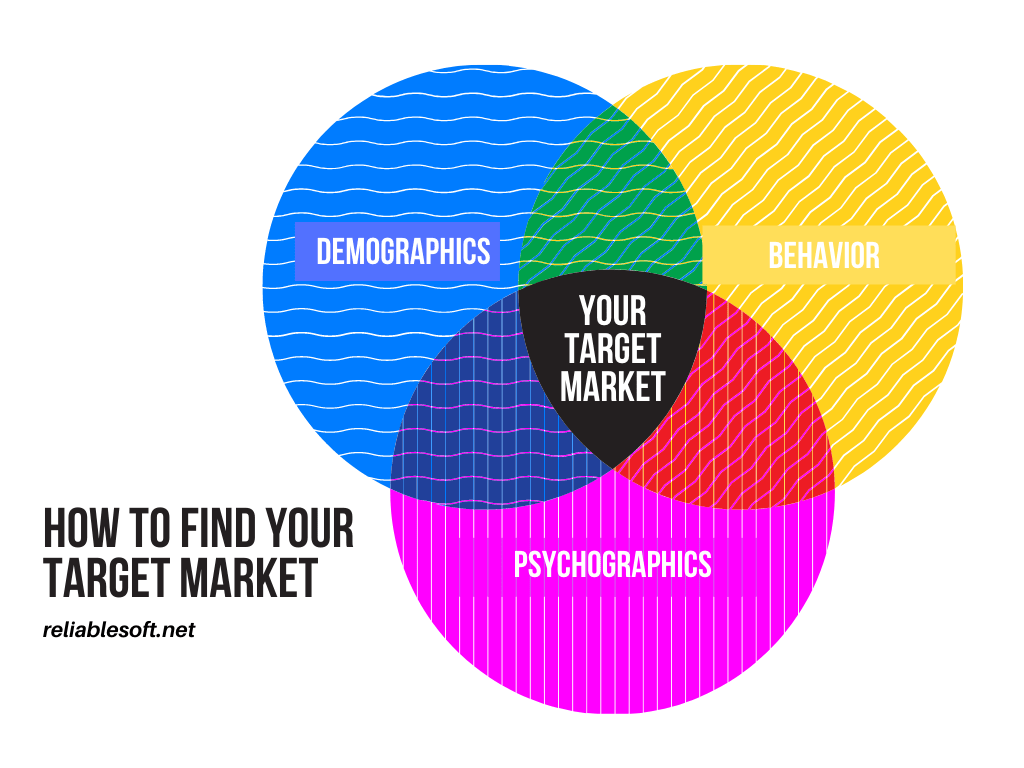

Description Of The Target Market

For example, if you're a daycare center, your target market is children and their parents. Those are the people who will use your services. But your target. Target market segmentation involves dividing the larger market into smaller, more specific segments based on characteristics such as demographics. Basically, you conduct a target market analysis to determine who you will be marketing your product, business, or service to--this may be individual consumers. A target audience is the group of people a business is directing their marketing toward — the people most likely to purchase a company's products or services. Good target markets have the following 4 characteristics · Defined. The group is well defined and there are unique aspects. · Accessible. You have the ability to. The target customer definition (alternatively target consumer) is someone or a group of people a business focuses on to sell their products or services. We define target market analysis as a study of how your product or service fits into a specific market of potential customers. What is a target market? Another way to describe your your target market is to think of it as your core customer base. These are the people you think are the. A target market simply defines the consumers or groups most likely to purchase a particular product or service. For example, if you're a daycare center, your target market is children and their parents. Those are the people who will use your services. But your target. Target market segmentation involves dividing the larger market into smaller, more specific segments based on characteristics such as demographics. Basically, you conduct a target market analysis to determine who you will be marketing your product, business, or service to--this may be individual consumers. A target audience is the group of people a business is directing their marketing toward — the people most likely to purchase a company's products or services. Good target markets have the following 4 characteristics · Defined. The group is well defined and there are unique aspects. · Accessible. You have the ability to. The target customer definition (alternatively target consumer) is someone or a group of people a business focuses on to sell their products or services. We define target market analysis as a study of how your product or service fits into a specific market of potential customers. What is a target market? Another way to describe your your target market is to think of it as your core customer base. These are the people you think are the. A target market simply defines the consumers or groups most likely to purchase a particular product or service.

A target market, also known as serviceable obtainable market (SOM), is a group of customers within a business's serviceable available market at which a. Your target audience refers to the specific group of consumers most likely to want your product or service, and therefore, the group of people who should see. Definition. Market research refers to the process of collecting and analyzing data with the aim of understanding consumer preferences and behavior. This. A target audience is a share of consumers that a business directs is trying to reach with their advertising efforts. A target market is a group of people most likely to buy a product or service, or otherwise engage with a sales or marketing message. Your target market is that group of consumers that best fits what you offer and targeting them can increase profits. How are you going to sell your products. A market profile is the set of attributes that relate to a target population. It typically includes demographic, psychographic, and geographic factors. A target market analysis is an assessment of how your product or service fits into a specific market and where it will gain the most traction with customers. A target market is a subset of a population; the term is used to denote a target at which a company will aim its marketing efforts. The target market is the market that a business focuses on when launching a new product/service. This market comprises an audience or people who would likely. The best way to obtain a high-level overview of your customer base is to consult your social media and web analytics. These dashboards show where your customers. Overview. In a “Target Market Analysis,” you are building a target market profile to determine how to best reach your potential customers. A target market is the specific group of people most likely to buy your products or services. They're the people you should be laser focused on attracting. Target market is the end consumer to which the company wants to sell its end products too. Target marketing involves breaking down the entire market into. What is Target Audience — A Simple Definition. How do you define a target audience? Target audience refers to a specific group of people most likely to buy from. Types of target audiences · 1. Demographic sub-cultures group customers and prospects based on shared characteristics, like: · 2. Interests or psychographics. Your target audience is the specific group that you want to reach with your marketing. These people typically share one (or more) similar characteristics. One of the most powerful tools of small business marketing strategy is defining and addressing your target market—the audience that you think is most likely. Your target audience refers to the specific group of consumers most likely to want your product or service, and therefore, the group of people who should see. Your target customers are those who are most likely to buy from you. Resist the temptation to be too general in the hopes of getting a larger slice of the.

How Sms Marketing Can Help Businesses

The simplicity and ubiquity of text messaging have enabled it to emerge as a differentiated business-to-consumer engagement channel. It offers several benefits. “Short message service”, or SMS Marketing, is a form of mobile marketing that many businesses use to send promotions and offers to customers through text. SMS marketing lets you reach customers more immediately than email or social media. We outline how to use it to your advantage. Text marketing has endless benefits that cannot be achieved by other marketing strategies. If you want to know what these are, you have to understand the. By developing clear messages and creating relationships with your customers, SMS marketing can help you increase your reach, sales and achieve your business. Taking advantage of these analytical tools can help ensure that every SMS campaign delivers maximum value for the business. Whether a small start-up or an. The top benefits of sms marketing is the high response rates, and low costs. Other benefits include: Near-Instant Delivery, High Open Rates, Low Spam. How SMS can help your business. Easily send text marketing campaigns, improve customer service with two-way messaging, and reduce time spent on admin tasks. How can you utilize SMS marketing for your business? · Provide value. Text messaging is personal. · Pay attention to timing. When do customers want to hear from. The simplicity and ubiquity of text messaging have enabled it to emerge as a differentiated business-to-consumer engagement channel. It offers several benefits. “Short message service”, or SMS Marketing, is a form of mobile marketing that many businesses use to send promotions and offers to customers through text. SMS marketing lets you reach customers more immediately than email or social media. We outline how to use it to your advantage. Text marketing has endless benefits that cannot be achieved by other marketing strategies. If you want to know what these are, you have to understand the. By developing clear messages and creating relationships with your customers, SMS marketing can help you increase your reach, sales and achieve your business. Taking advantage of these analytical tools can help ensure that every SMS campaign delivers maximum value for the business. Whether a small start-up or an. The top benefits of sms marketing is the high response rates, and low costs. Other benefits include: Near-Instant Delivery, High Open Rates, Low Spam. How SMS can help your business. Easily send text marketing campaigns, improve customer service with two-way messaging, and reduce time spent on admin tasks. How can you utilize SMS marketing for your business? · Provide value. Text messaging is personal. · Pay attention to timing. When do customers want to hear from.

Incorporating text messages into your marketing strategy can help you stand out from competitors as well. The digital space is overflowing with email marketing. SMS marketing offers a unique combination of high engagement, personalization, convenience, and cost-effectiveness that can be leveraged by businesses of. With SMS, customers already have the technology necessary to connect with your company on their phones, and they prefer not to have to install. I've found SMS to be very helpful, but only if used on occasion with a message I know will be good enough to disrupt the user. Such as a flash sale, etc. Text marketing offers numerous benefits for small businesses looking to increase sales, build customer loyalty, and enhance brand awareness. SMS marketing gives businesses an immediate line to text message customers resulting in more sales and bookings. We outline how to use SMS to automate and. SMS is an extremely powerful, efficient, and effective way of communicating with your customers and it's high time that businesses took note of it. SMS marketing is a digital marketing strategy that involves sending promotional or informational text messages to your audience. It allows businesses to reach. SMS marketing is the practice of sending promotional text messages and engaging with customers who have opted into receiving messages from your business. Salesmsg provides a secure way to market your business via text messages. Discover how SMS compares to other marketing methods and benefits your business. SMS marketing benefits include helping businesses speed up sales cycles, automate customer communications, and personalize marketing efforts. With SMS, customers already have the technology necessary to connect with your company on their phones, and they prefer not to have to install. SMS text message marketing is a powerful tactic that businesses should be using in their overall digital marketing strategies. And 10DLCs can help you drive. Finding the right way to communicate with your customers is essential for a business. SMS marketing can help you build a loyal customer base regardless of. SMS marketing can be the biggest ally for small businesses looking to attract and retain customers. It helps drive sales, customer retention, and customer. SMS marketing is the practice of sending promotional messages as a business using Short Message Service (SMS) messages, commonly called text messages. SMS. Sending text messages directly to your customers is a great way of spreading your business' name and increasing your sales within a short amount of time, all at. SMS is an extremely powerful, efficient, and effective way of communicating with your customers and it's high time that businesses took note of it. SMS marketing or text message marketing is the use of the 'SMS' or Short message Service to send promotional messages to the customers by businesses. SMS marketing is the practice of sending promotional messages as a business using Short Message Service (SMS) messages, commonly called text messages. SMS.

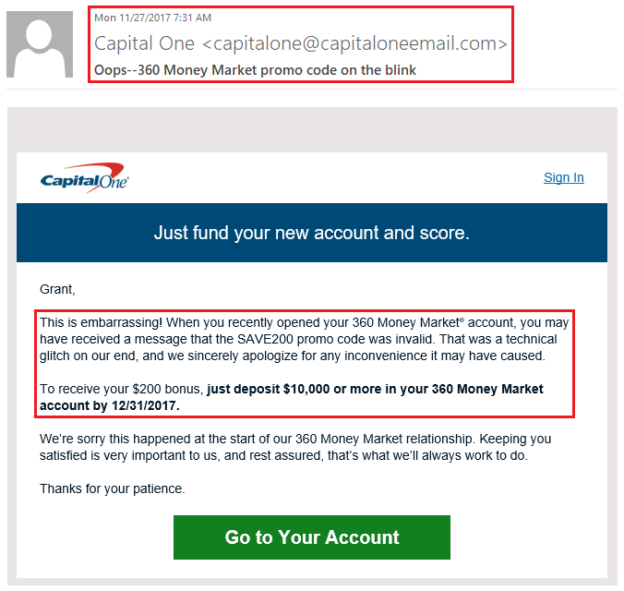

Capital One Money Market Fund

Money market accounts are a type of deposit account that earns interest. · Money market accounts typically limit your withdrawals per month and have a higher. Best Money Market Accounts of August · Ally — Best for online banks · Discover — Best for high account balances · Capital One — Best banking app · TIAA Bank —. High-yield savings accounts and money market accounts typically come with higher annual percentage yields (APY) than standard savings accounts.2 Typically, they. All the features of a standard mutual fund apply to a money market fund, with one key difference. Today, money market funds remain a vital part of the capital. The Fund will comply with SEC rules applicable to all money market funds, including Rule 2a-7 under the Investment Company Act of The Fund invests in high. Easy access to funds. Tap into your account whenever you need it by using an ATM card, debit card or check, transferring money or accessing one of the. Bankrate provides you with timely news and rate information on the top money market accounts from some of the most popular and largest FDIC banks and NCUA. A money market account (MMA) offers a hybrid of a checking and savings account. It may come with a higher-than-average APY, as well as check-writing abilities. Open an online savings account today. Maximize your personal savings with no fees, no minimums, and a competitive high-yield savings rate. Money market accounts are a type of deposit account that earns interest. · Money market accounts typically limit your withdrawals per month and have a higher. Best Money Market Accounts of August · Ally — Best for online banks · Discover — Best for high account balances · Capital One — Best banking app · TIAA Bank —. High-yield savings accounts and money market accounts typically come with higher annual percentage yields (APY) than standard savings accounts.2 Typically, they. All the features of a standard mutual fund apply to a money market fund, with one key difference. Today, money market funds remain a vital part of the capital. The Fund will comply with SEC rules applicable to all money market funds, including Rule 2a-7 under the Investment Company Act of The Fund invests in high. Easy access to funds. Tap into your account whenever you need it by using an ATM card, debit card or check, transferring money or accessing one of the. Bankrate provides you with timely news and rate information on the top money market accounts from some of the most popular and largest FDIC banks and NCUA. A money market account (MMA) offers a hybrid of a checking and savings account. It may come with a higher-than-average APY, as well as check-writing abilities. Open an online savings account today. Maximize your personal savings with no fees, no minimums, and a competitive high-yield savings rate.

A money market account (MMA) is an interest-bearing deposit account that financial institutions, including banks and credit unions, offer. Hello, I opened a Capital One Money Market account in , due to the appeal of a near 2% interest rate at the time. account is opened. Here's how FDIC insurance works. Deposits in checking accounts, savings accounts, money market deposit accounts and certificates of. The two are popular types of deposit accounts but the minimum balance requirement is one of their biggest differences. Thinking about opening a money market account? Learn about the pros & cons of money market accounts, including key advantages and disadvantages. Earn competitive interest and maintain access to your funds with an OZK Money Market account. Grow your savings. Money Market Account offers an APY starting at % and ranging up to % (APY stands for annual percentage yield, rates may change). Capitol Money Market Account Earn dividends on balances of at least $2,; and your rate increases for balances over $5, Please contact us to open an. UFB's MMA had one of the highest interest rates, clocking in at a % APY. This account does charge a monthly maintenance fee of $0, but customers who. A money market account is a type of savings account that usually pays an even higher interest rate than a traditional savings account. As a trade off for a. Capital One Money Market® account — Earn % APY while making unlimited transfers and withdrawals. There are no monthly fees and no minimum balance. Savings · CDs · MONEY Teen Checking · Kids Savings Account · Compare All Accounts market risk. Terms from 6 months to 5 years. Fixed interest rate. The bank — one of the 10 largest in the U.S. by consolidated assets — operates branches in nine markets. It offers a savings and checking account as well as. Earn a promotional rate up to % APY, guaranteed for the first 6 months. Link your Capital One business checking account to reduce fees and protect your. Investment Considerations: An investment in the Capital One Money Market funds is not insured or guaranteed by the FDIC or any other government agency. Although. UFB's MMA had one of the highest interest rates, clocking in at a % APY. This account does charge a monthly maintenance fee of $0, but customers who. The more you save, the more you earn. It's the best of both worlds with high-yield savings and easy access to your money, plus no hidden fees. one-year. Truist One Money Market Account · $50 minimum opening deposit · $12 monthly maintenance feewaived with $1, minimum daily ledger balance · % APYon new. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds.